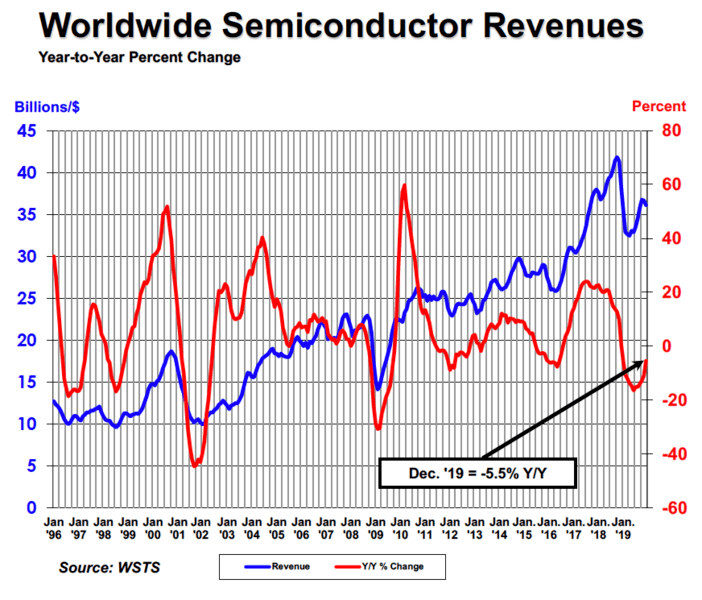

Worldwide Semiconductor Sales Decrease 12 Percent to $412 Billion in 2019

Monday, Feb 03, 2020, 4:30pm

by Semiconductor Industry Association

Fourth-quarter sales were 5.5 percent lower than 2018 Q4, 0.9 percent higher than 2019 Q3

WASHINGTON—Feb. 3, 2020—The Semiconductor Industry Association (SIA) today announced the global semiconductor industry sales were $412.1 billion in 2019, a decrease of 12.1 percent compared to the 2018 total. Global sales for the month of December 2019 reached $36.1 billion, a decline of 5.5 percent compared to the December 2018 total and 1.7 percent less than the total from November 2019. Fourth-quarter sales of $108.3 billion were 5.5 percent lower than the total from the fourth quarter of 2018, but 0.9 percent higher than the third quarter of 2019. All monthly sales numbers are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents U.S. leadership in semiconductor manufacturing, design, and research.

“Amid a confluence of factors, including ongoing global trade unrest and cyclicality in product pricing, worldwide sales of semiconductors were down considerably in 2019, falling 12 percent year-to-year,” said John Neuffer, SIA president and CEO. “The global market rebounded somewhat during the second half of 2019, increasing slightly from Q3 to Q4, and modest annual growth is projected for 2020. Policies that promote free trade and ensure open access to global markets are needed for continued recovery in the coming months. Ratification of the U.S.-Mexico-Canada Agreement (USMCA) and signing of the ‘phase one’ U.S.-China trade agreement are positive steps.”

“Amid a confluence of factors, including ongoing global trade unrest and cyclicality in product pricing, worldwide sales of semiconductors were down considerably in 2019, falling 12 percent year-to-year,” said John Neuffer, SIA president and CEO. “The global market rebounded somewhat during the second half of 2019, increasing slightly from Q3 to Q4, and modest annual growth is projected for 2020. Policies that promote free trade and ensure open access to global markets are needed for continued recovery in the coming months. Ratification of the U.S.-Mexico-Canada Agreement (USMCA) and signing of the ‘phase one’ U.S.-China trade agreement are positive steps.”

Several semiconductor product segments stood out in 2019. Memory and logic were the largest semiconductor categories by sales, each totaling $106.4 billion in 2019 sales. Sales of memory products were down significantly in 2019 by dollar value, decreasing 32.6 percent compared to 2018. Memory unit volume increased slightly, however. Within the memory category, sales of DRAM products decreased 37.1 percent and sales of NAND flash products decreased 25.9 percent. Not including sales of memory products, sales of all other products combined declined by 1.7 percent in 2019. Micro-ICs ($66.4 billion) – a category that includes microprocessors – was the third-largest product category in terms of total sales. Sales of optoelectronics products were a bright spot, increasing 9.3 percent year-to year in 2019.

Annual sales declined across all regions: Europe (-7.3 percent), China (-8.7 percent), Asia Pacific/All Other (-9.0 percent), Japan (-10.0 percent), and the Americas (-23.8 percent). Sales for the month of December 2019 increased compared to November 2019 in the Americas (0.1 percent), but fell in Japan (-2.0 percent), Asia Pacific/All Other (-2.2 percent), Europe (-4.5 percent), and China (-1.5 percent).

For comprehensive monthly semiconductor sales data and detailed WSTS Forecasts, consider purchasing the WSTS Subscription Package. For detailed historical information about the global semiconductor industry and market, consider ordering the SIA Databook.

[December 2019 chart and graph]

# # #

Media Contact

Dan Rosso

Semiconductor Industry Association

202-446-1719

drosso@semiconductors.org

About SIA

The Semiconductor Industry Association (SIA) is the voice of the semiconductor industry, one of America’s top export industries and a key driver of America’s economic strength, national security, and global competitiveness. Semiconductors – the tiny chips that enable modern technologies – power incredible products and services that have transformed our lives and our economy. The semiconductor industry directly employs nearly a quarter of a million workers in the United States, and U.S. semiconductor company sales totaled $193 billion in 2019. SIA members account for nearly 95 percent of all U.S. semiconductor industry sales. Through this coalition, SIA seeks to strengthen leadership of semiconductor manufacturing, design, and research by working with Congress, the Administration, and key industry stakeholders around the world to encourage policies that fuel innovation, propel business, and drive international competition. Learn more at www.semiconductors.org.

About WSTS

World Semiconductor Trade Statistics (WSTS) is an independent non-profit organization representing the vast majority of the world semiconductor industry. The mission of WSTS is to be the respected source of semiconductor market data and forecasts. Founded in 1986, WSTS is the singular source for monthly industry shipment statistics.