Global Governments Ramp Up Pace of Chip Investments

Wednesday, Jun 02, 2021, 12:30pm

by Jennifer Meng, Director of Global Policy

The strategic significance of semiconductors and their ever-increasing importance for economic competitiveness and supply-chain resilience has become a focus for governments worldwide. The widespread global chip shortage as a result of the COVID-19 crisis in late 2020 has shown that vulnerabilities in the global semiconductor supply chain put at risk many technologies and products essential to our daily lives. Indeed, the United States is now vulnerable to supply-chain disruptions as it has fallen behind global competition in providing support for this strategic sector.

The strategic significance of semiconductors and their ever-increasing importance for economic competitiveness and supply-chain resilience has become a focus for governments worldwide. The widespread global chip shortage as a result of the COVID-19 crisis in late 2020 has shown that vulnerabilities in the global semiconductor supply chain put at risk many technologies and products essential to our daily lives. Indeed, the United States is now vulnerable to supply-chain disruptions as it has fallen behind global competition in providing support for this strategic sector.

Other governments have long understood the strategic importance of semiconductors and sought to provide fiscal support for their sectors. A recent study found that the global nature of the semiconductor supply chain is one of the key reasons for this industry’s success, and semiconductor self-sufficiency is nearly impossible to achieve for any one company or country. Accelerating geopolitical tensions, however, have further underscored the urgency for some governments to rebalance and strengthen their position within the global chip supply chain. The United States, too, has put forward a bold, $52 billion plan to revitalize its chip manufacturing and research. The provisions of this plan were authorized by the CHIPS for America Act, which was enacted earlier this year, but funding must now be provided to make these initiatives a reality. Otherwise, America risks falling behind.

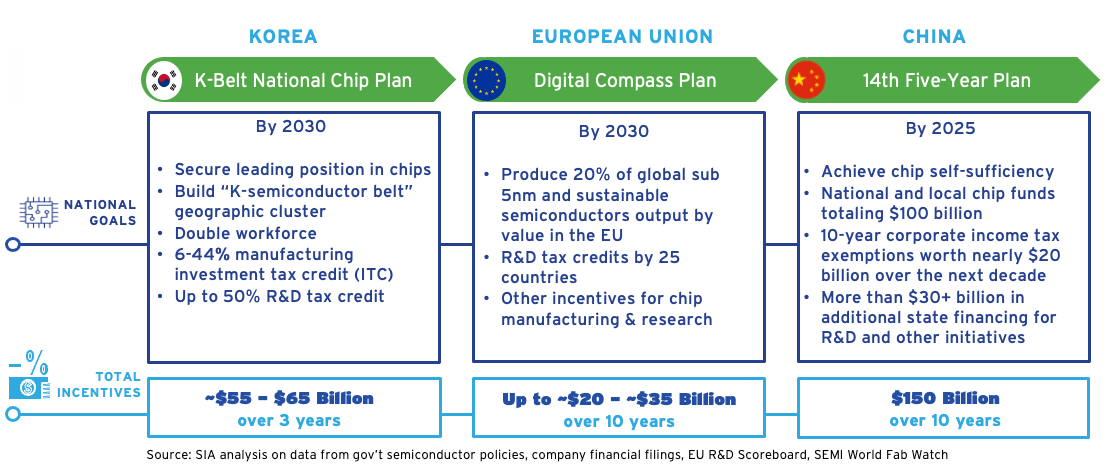

In fact, multiple governments across the world have been reassessing their positions across the semiconductor value chain and looking to act, rolling out new national industrial policies and significant investments for semiconductor manufacturing and R&D within their borders. In the past several years, China, Korea, and the EU – all major players in the semiconductor industry – have announced the potential for up to $250 billion in government investments over the next decade dedicated to the semiconductor industry.

- China: The development of the semiconductor industry has long been a priority for China, but it gained renewed urgency over the last few years, and China has set an explicit national goal of achieving “self-sufficiency” in all segments of the semiconductor value chain in its recent 14th Five-Year Plan. Since 2018, China has funded the construction of more than 52 fabs through a range of support measures, including grants, equity investment, reduced utility rates, favorable loans, and tax breaks. In addition to the creation of the $50 billion National IC Fund, China has announced more than 15 local IC funds dedicated to injecting equity into Chinese semiconductor companies, amounting to over $100 billion. Based on SIA’s analysis, the Chinese government owns about 40% of its top 100 semiconductor companies, a ratio unmatched in any other country. In August 2020, China expanded its semiconductor preferential tax policies, which include up to a 10-year corporate tax exemption for semiconductor manufacturers, which could be valued at over another $20 billion.

- South Korea: On May 12, 2021, South Korean President Moon Jae-in unveiled a new national semiconductor industrial policy aimed at securing the country’s leading position in chips by 2030. Named the “K-Belt Semiconductor Strategy” due to its focus on geographic clusters, the plan includes generous tax credits of up to 50% for R&D and 16% for manufacturing, $886 million USD in long-term loans, $1.3 billion in federal R&D investments, eased regulations, and upgraded infrastructure. SIA estimates these new tax breaks for Korean chip firms could amount to nearly $55-$65 billion in incentives over the next three years. Citing U.S. and Chinese efforts to double-down on their chip industries, President Moon stressed that Korea “needs pre-emptive investments to lead the global supply chain to make this opportunity ours.”

- European Union: The European Commission and its member states have been taking concrete steps to strengthen Europe’s “strategic autonomy” in semiconductors, including plans to allocate up to 35 billion euros to boost the EU’s advanced semiconductor production capabilities. In March 2021, the EU unveiled the “2030 Digital Compass Initiative,” which explicitly set a goal of increasing the EU’s share of global chip manufacturing to 20% by 2030, up from below 10% today. The initiative highlights the significant gaps in the EU for “state-of-the-art fabrication technologies and in chip design, exposing Europe to a number of vulnerabilities.”

- India & Japan: This month political leaders in Japan set up a task force to develop their own industrial policy to revitalize the Japanese chipmaking sector, including a planned focus on manufacturing, equipment, and materials. Elsewhere in Asia, India last year announced that it would offer over a billion dollars for each new fab set up locally and will encourage other investments across the semiconductor value chain.

With countries around the world investing hundreds of billions of dollars to promote the competitiveness of their semiconductor industries and bolster domestic chip manufacturing, funding the incentives called for in the CHIPS Act is even more pressing to maintain U.S. leadership in semiconductors. In addition to bolstering U.S. competitiveness, it is essential the U.S. government increase dialogue and communication with key global partners on supply chain issues. Recent announcements that the U.S. will set up semiconductor dialogues with Japan and South Korea are welcome steps in that direction.

The semiconductor industry stands ready to work with the U.S. government to ensure the U.S. remains the leader in the game-changing technologies of today and tomorrow.