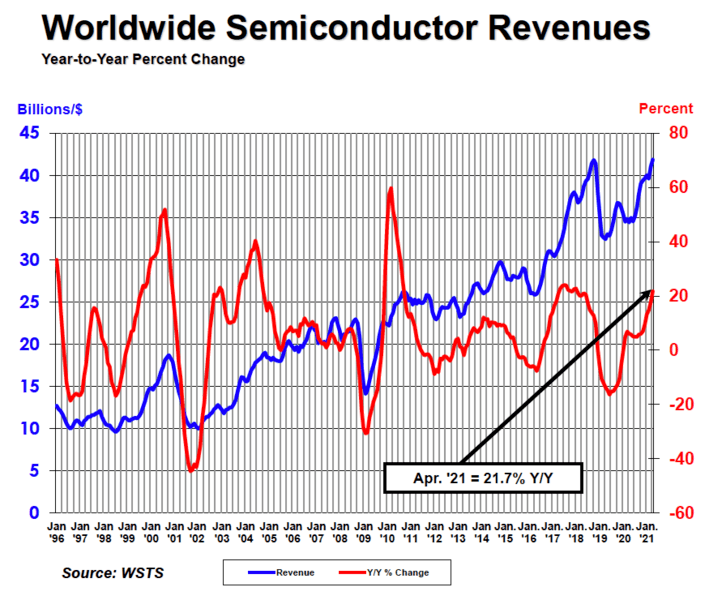

Global Semiconductor Sales Increase 1.9% Month-to-Month in April; Annual Sales Projected to Increase 19.7% in 2021, 8.8% in 2022

Wednesday, Jun 09, 2021, 8:00am

by Semiconductor Industry Association

WASHINGTON—June 9, 2021—The Semiconductor Industry Association (SIA) today announced worldwide sales of semiconductors were $41.8 billion in April 2021, an increase of 1.9% from the March 2021 total of $41.0 billion and 21.7% more than the April 2020 total of $34.4 billion. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. Additionally, a newly released WSTS industry forecast projects annual global sales will increase 19.7% in 2021 and 8.8% in 2022. SIA represents 98% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

“Global demand for semiconductors remained high in April, as reflected by rising sales across a range of chip products and throughout each of the world’s major regional markets,” said John Neuffer, SIA president and CEO. “The global chip market is projected to grow substantially in 2021 and 2022 as semiconductors become increasingly integral to the game-changing technologies of today and the future.”

“Global demand for semiconductors remained high in April, as reflected by rising sales across a range of chip products and throughout each of the world’s major regional markets,” said John Neuffer, SIA president and CEO. “The global chip market is projected to grow substantially in 2021 and 2022 as semiconductors become increasingly integral to the game-changing technologies of today and the future.”

Regionally, month-to-month sales increased across all major regional markets: the Americas (3.3%), Japan (2.6%), China (2.3%), Europe (1.6%), and Asia Pacific/All Other (0.5%). On a year-to-year basis, sales increased in China (25.7%), Asia Pacific/All Other (24.3%), Europe (20.1%), Japan (17.6%), and the Americas (14.3%).

Additionally, SIA today endorsed the WSTS Spring 2021 global semiconductor sales forecast, which projects the industry’s worldwide sales will be $527.2 billion in 2021, a 19.7% increase from the 2020 sales total of $440.4 billion. WSTS projects year-to-year increases in Asia Pacific (23.5%), Europe (21.1%), Japan (12.7%), and the Americas (11.1%). In 2022, the global market is projected to post slower – but still substantial – growth of 8.8%. WSTS tabulates its semi-annual industry forecast by gathering input from an extensive group of global semiconductor companies that provide accurate and timely indicators of semiconductor trends.

For comprehensive monthly semiconductor sales data and detailed WSTS forecasts, consider purchasing the WSTS Subscription Package. For detailed historical information about the global semiconductor industry and market, consider ordering the SIA Databook.

To learn more about the global semiconductor supply chain, download the new SIA/Boston Consulting Group Report: Strengthening the Global Semiconductor Supply Chain in an Uncertain Era.

[April 2021 chart and graph]

# # #

Media Contact

Dan Rosso

Semiconductor Industry Association

240-305-4738

drosso@semiconductors.org

About SIA

The Semiconductor Industry Association (SIA) is the voice of the semiconductor industry, one of America’s top export industries and a key driver of America’s economic strength, national security, and global competitiveness. Semiconductors – the tiny chips that enable modern technologies – power incredible products and services that have transformed our lives and our economy. The semiconductor industry directly employs over a quarter of a million workers in the United States, and U.S. semiconductor company sales totaled $208 billion in 2020. SIA represents 98% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms. Through this coalition, SIA seeks to strengthen leadership of semiconductor manufacturing, design, and research by working with Congress, the Administration, and key industry stakeholders around the world to encourage policies that fuel innovation, propel business, and drive international competition. Learn more at www.semiconductors.org.

About WSTS

World Semiconductor Trade Statistics (WSTS) is an independent non-profit organization representing the vast majority of the world semiconductor industry. The mission of WSTS is to be the respected source of semiconductor market data and forecasts. Founded in 1986, WSTS is the singular source for monthly industry shipment statistics.