How Did the Global Semiconductor Market Reach Record Sales in 2014?

Friday, Feb 06, 2015, 7:00pm

by Semiconductor Industry Association

Last November, when I wrote about industry sales through the third quarter of 2014, I said that it was hard to envision final 2014 sales not being the highest annually on record and that a more interesting question to consider was whether final 2014 annual sales would surpass the World Semiconductor Trade Statistics’ (WSTS) forecast at the time of 6.5 percent growth, which WSTS later revised to 9.0 percent growth.

As the final 2014 Global Sales Report revealed earlier this week, 2014 annual sales were indeed record-breaking at $335.8 billion, and annual growth did indeed surpass not just WSTS’s old forecast of 6.5 percent but also its revised forecast of 9.0 percent, coming in at 9.9 percent. Besides the annual year-over-year record sales increase in 2014, quarterly year-over-year and monthly year-over-year (December) sales also grew by 9.3 percent each.

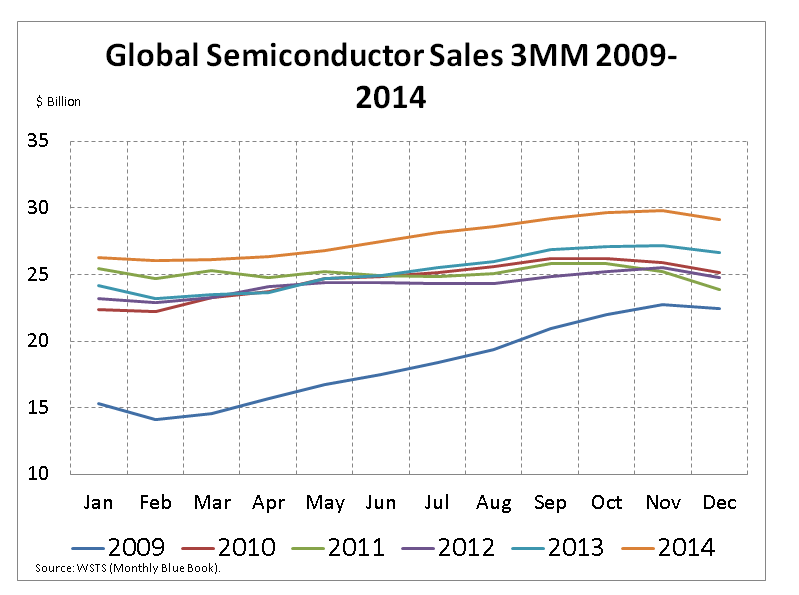

The table below compares 2014 monthly global semiconductor sales totals (on a three-month moving average) with monthly sales totals from 2009 through 2013. From the start to the end of 2014, monthly sales were consistently ahead of the pace set in each of the previous five years. [Source: World Semiconductor Trade Statistics (WSTS) data]

Annual sales growth was positive across all major geographical markets and virtually all major product segments. Last year was the first since 2010 that the industry achieved positive year-over-year growth in all four major regional markets: the Americas increased by 12.7 percent, Asia Pacific by 11.4 percent, Europe by 7.4 percent, and Japan by 0.1 percent. Asia-Pacific represented the largest regional market in terms of total sales at $194 billion with the Americas the second largest of the four at $69 billion. Positive GDP growth in the U.S. economy in 2014 contributed to the strong semiconductor sales growth in the Americas region.

On a product basis, while growth in 2014 was led again by memory sales (18.2 percent increase) as it was in 2013, 2014 differed in that virtually all other product segments experienced positive growth as well, indicating that 2014 growth was more broad-based. Three other product segments, in fact, also experienced double digit growth in 2014: power transistors (16.1 percent increase), discretes (10.8 percent increase), and analog (10.6 percent increase). The top three product categories in terms of total sales were logic ($91.6 billion), memory ($79.2 billion), and micro-ICs ($62.1 billion).