India’s IC Imports Grew Dramatically in 2018, and U.S.-China Trade Tensions Could be a Reason

Tuesday, Jun 11, 2019, 1:53pm

by Semiconductor Industry Association

As semiconductor supply chains begin shifting due to the U.S.-China trade conflict, could one of the beneficiaries be India? An analysis of recent trade data, as well as recent news reporting, suggest this could be the case.

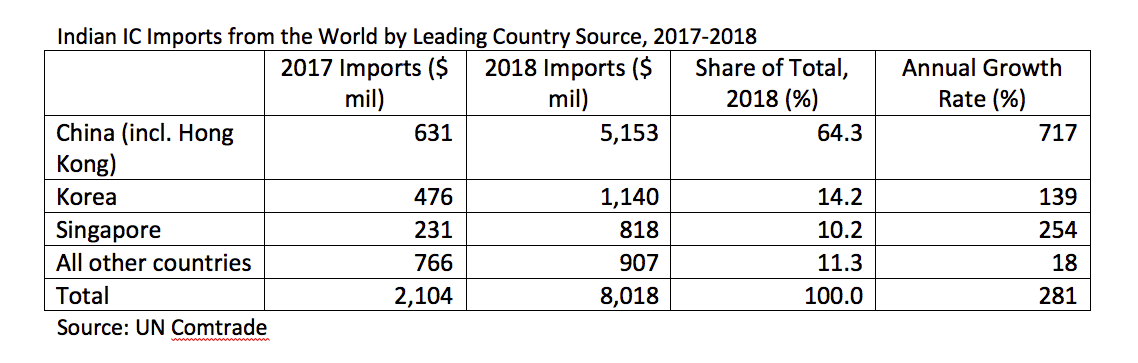

The increase in integrated circuit (IC) imports into India from the world in 2018 was dramatic and hard to ignore. According to data from the United Nations Comtrade (UN Comtrade) database, annual IC imports into India in 2018 jumped by 281 percent to $8 billion. This is after consistently modest annual imports ranging from $1.5 to $2 billion from 2014-2017.

The largest increases in India’s IC imports were from China. In 2017, China was already the leading source of Indian IC imports, accounting for 30 percent of all Indian IC imports, and that share grew to 64 percent in 2018. The annual growth rate in Indian IC imports from China was a whopping 717 percent.

What is going on to cause such a sudden and dramatic increase in Indian IC imports from China? A few factors are playing a role.

First, the ongoing trade tensions between the U.S. and China are causing some tech firms to rebalance their supply chains out of China and into other countries such as India. Moving supply chains from China to India would cause ICs that are currently finished and sold in China to instead be exported out of China to these relocated tech firms that purchase IC components for assembly into their final products. This trend seems to be particularly common in the mobile telecom space.

Second, increased tariffs on Indian imports of finished mobile phones, but not mobile phone parts, may be incentivizing firms to move assembly operations into India to avoid the higher tariffs of importing completed phones into India. Avoiding higher tariffs on finished phones might be one reason Apple, for example, will reportedly increase iPhone assembly operations in India.

Finally, India remains a major market for mobile phones, and advantages exist to producing close to your end market. Even some Chinese mobile phone firms see value in moving assembly operations out of China and into India in order to better compete in the local market.

Time will tell whether this recent trend of India becoming more integrated into the semiconductor global supply chain is here to stay. One thing is clear: the U.S.-China trade conflict is prompting some in industry to make decisions they would have not otherwise contemplated.